12 minutes of info you need to see.

Friday, December 31, 2010

Thursday, December 30, 2010

Silver...Buy, Buy, Buy Before It Goes Bye, Bye, Bye

Silver may be the best buy when it comes to precious metals. You should consider getting some before it is too late.

Like I said, you better get some before it is too late, read here.

Prepare like there is no tomorrow, because someday there may not be a tomorrow like there is today.

Like I said, you better get some before it is too late, read here.

Prepare like there is no tomorrow, because someday there may not be a tomorrow like there is today.

The Big Fed Con

To understand how the Fed works, how the big banks work and how our politicians work, watch these two videos.

Silver $500 per Ounce?

I said silver, not gold. Well Max Keiser thinks it could reach $500/oz. Listen to the first ten minutes of this video.

Friday, December 24, 2010

Thursday, December 23, 2010

More Is Coming

There will be more cities defaulting on pension funds in the future. It has started with Prichard, AL. This is a small fund with 150 workers receiving a monthly check. Some people are going bankrupt, others relying on help from friends and family. I have a feeling 2011 won't be a good year.

I have been telling you for a while now to prepare, stock up on food and ways to protect yourself. Why you ask? What are these people going to do when their monthly checks run dry? Remember not all people receiving checks are 60+ years old. There are some that are getting checks due to "injuries" sustained while on the job. People will be getting desperate for anything to sell to get food for themselves or their family. What would you do to feed your family? Remember you are a law abiding citizen, some of these people will be looting and pillaging and who knows what else. We are close to tearing the thin film of morality for our society, that precautions while you still can.

Alabama Town’s Failed Pension Is a Warning

I have been telling you for a while now to prepare, stock up on food and ways to protect yourself. Why you ask? What are these people going to do when their monthly checks run dry? Remember not all people receiving checks are 60+ years old. There are some that are getting checks due to "injuries" sustained while on the job. People will be getting desperate for anything to sell to get food for themselves or their family. What would you do to feed your family? Remember you are a law abiding citizen, some of these people will be looting and pillaging and who knows what else. We are close to tearing the thin film of morality for our society, that precautions while you still can.

Alabama Town’s Failed Pension Is a Warning

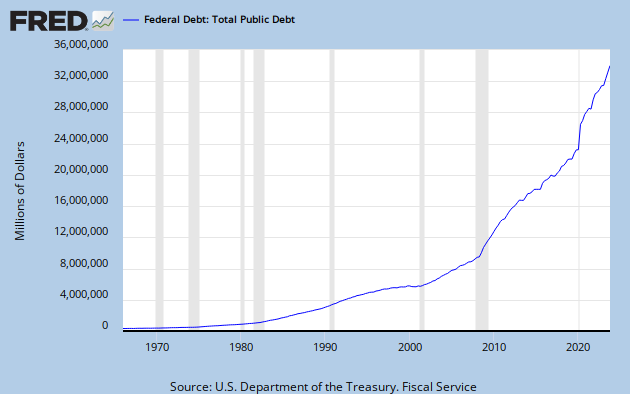

The Federal Debt Doubled In 5 Years

http://dailyreckoning.com/how-to-double-the-debt-in-5-years/

The above article is truely an eyeopener. Take the time and read it, but for those that don't like to read, I'll highlight a few snipets out so you can see the trouble we are in.

The above article is truely an eyeopener. Take the time and read it, but for those that don't like to read, I'll highlight a few snipets out so you can see the trouble we are in.

12/22/10 Tampa, Florida – As a paranoid and angry lunatic, I am always nervous and on the suspicious lookout for subtle signs of danger that I know are all around me because the foul Federal Reserve has created, and is still creating, So Freaking Much Money (SFFM), which means that the terror of ruinous inflation in prices is a dead-bang, take-it-to-the-bank, guaranteed certainty.

And there is no telling what people will do when faced with both the ruinous deflation of the value of their assets and the unbelievable, catastrophic inflation in the prices of food and energy that seems so sadly certain, which is a nice phrase if I do say so myself, conveying, as it does, a sense of resigned melancholy instead of my more usual hyperbole of anger, hatred, betrayal, outrage and thirst for revenge against the treacherous Federal Reserve for creating so much excess money and against the corrupt Congress for allowing it!

Unfortunately, this is not about how I have the lyrical soul of a poet, but about how these people are the same average idiotic Americans who have, for more than half of the last century, been electing and reelecting Congresses that have enacted huge, growing, cancerous budgets that deficit-spent a gigantic $14 trillion in new national debt – a sum equaling GDP!

And these same disastrous weenies have borrowed and deficit-spent more than half of that $14 trillion national debt in just the last 10 years! And now they are on track to double the debt again in the next 5 years! Gaaah!! We’re freaking doomed!

Doug Noland in his PrudentBear.com commentary does not mention this kind of mental and fiscal insanity directly, much less leading to the Hysterical Mogambo Conclusion (HMC) that we should be frantically buying gold, silver and oil in a frenzied, single-minded panic.

Instead, with the calm and dispassionate objectivity of the classic reporter, he notes that the latest Federal Reserve Z.1 “flow of funds” report shows that “This year will mark the second consecutive year where federal borrowings will have actually expanded more than the growth of total Non-financial borrowings. Nothing similar to this has happened in the post-WWII period.”

Yow! This is the kind of “danger signal” that I am talking about!

The actual figures are that in just the last 9 quarters, which a little over 2 years, “total federal liabilities” exploded by a whopping $4.013 trillion, which increased the national debt by 60% in those aforementioned Two Freaking Years (TFY)! TFY!

Even more astoundingly, “After doubling mortgage Credit in less than 7 years, our system is now on track to double federal debt in about four years.” Gaaahhhh! I thought it was 5 years! I scream anew in outrage and fear! Gaaahhh!

Suddenly, I am screaming in fear, but at the same time I am watching, as if in an out-of-body experience, little specks of spittle fly out of my mouth as I am screaming, and I am thinking to myself, “That’s the problem with linear thinking! If I pursued a career of fame and fortune as The World’s Fattest Man (TWFM) and weighed in at 1,500 pounds, can I actually double my weight in 4 years to 3,000 pounds? And then 4 years later double my weight again to 6,000 pounds? And then again to weigh 12,000 pounds?”

The answer is, obviously, “Not without a lot of tasty grub! Hahahaha!”

Fortunately, speaking of tasty grub calms me down enough so that I can read that the report also showed that combined local, state, and federal expenditures were up, and still totals about half of our $14 trillion GDP, even though the federal government borrowed and spent a whopping $1.8 trillion in the last 12 months, which may explain how Total Compensation increased 3.0% in the last year, rising to $8.03 trillion, which seems paradoxical since unemployment, at an “official” 9.8% and (according to John Williams at shadowstats.com) is unofficially 22%, is a Big, Big Problem (BBP).

Even more surprising was that Household Assets increased $1.2 trillion to $68.8 trillion, while Household Liabilities were $13.9 trillion and did not increase much because, I assume, people did not spend a lot of borrowed money in the last quarter.

The report handily subtracts liabilities from assets and concludes that that Household Net Worth increased $1.19 trillion during the third quarter, rising to a surprising $54.9 trillion, which is almost 4 times Liabilities, thus everything should be peachy keen and couldn’t be better except for, you know, that pesky unemployment thing.

If you believe that, then you will not be interested in the Mogambo Big Plan (MBP) to buy gold, silver and oil as protection against the roaring, catastrophic inflation caused by the Federal Reserve creating so much money, and the federal government borrowing it and spending it.

And to tell you the truth, I don’t know whether or not I believe any of it, and I only follow the Mogambo Big Plan (MBP) because it is fool-proof and so easy that I giggle with childish delight, “Whee! This investing stuff is easy!”

The Mogambo Guru

for The Daily Reckoning

And there is no telling what people will do when faced with both the ruinous deflation of the value of their assets and the unbelievable, catastrophic inflation in the prices of food and energy that seems so sadly certain, which is a nice phrase if I do say so myself, conveying, as it does, a sense of resigned melancholy instead of my more usual hyperbole of anger, hatred, betrayal, outrage and thirst for revenge against the treacherous Federal Reserve for creating so much excess money and against the corrupt Congress for allowing it!

Unfortunately, this is not about how I have the lyrical soul of a poet, but about how these people are the same average idiotic Americans who have, for more than half of the last century, been electing and reelecting Congresses that have enacted huge, growing, cancerous budgets that deficit-spent a gigantic $14 trillion in new national debt – a sum equaling GDP!

And these same disastrous weenies have borrowed and deficit-spent more than half of that $14 trillion national debt in just the last 10 years! And now they are on track to double the debt again in the next 5 years! Gaaah!! We’re freaking doomed!

Doug Noland in his PrudentBear.com commentary does not mention this kind of mental and fiscal insanity directly, much less leading to the Hysterical Mogambo Conclusion (HMC) that we should be frantically buying gold, silver and oil in a frenzied, single-minded panic.

Instead, with the calm and dispassionate objectivity of the classic reporter, he notes that the latest Federal Reserve Z.1 “flow of funds” report shows that “This year will mark the second consecutive year where federal borrowings will have actually expanded more than the growth of total Non-financial borrowings. Nothing similar to this has happened in the post-WWII period.”

Yow! This is the kind of “danger signal” that I am talking about!

The actual figures are that in just the last 9 quarters, which a little over 2 years, “total federal liabilities” exploded by a whopping $4.013 trillion, which increased the national debt by 60% in those aforementioned Two Freaking Years (TFY)! TFY!

Even more astoundingly, “After doubling mortgage Credit in less than 7 years, our system is now on track to double federal debt in about four years.” Gaaahhhh! I thought it was 5 years! I scream anew in outrage and fear! Gaaahhh!

Suddenly, I am screaming in fear, but at the same time I am watching, as if in an out-of-body experience, little specks of spittle fly out of my mouth as I am screaming, and I am thinking to myself, “That’s the problem with linear thinking! If I pursued a career of fame and fortune as The World’s Fattest Man (TWFM) and weighed in at 1,500 pounds, can I actually double my weight in 4 years to 3,000 pounds? And then 4 years later double my weight again to 6,000 pounds? And then again to weigh 12,000 pounds?”

The answer is, obviously, “Not without a lot of tasty grub! Hahahaha!”

Fortunately, speaking of tasty grub calms me down enough so that I can read that the report also showed that combined local, state, and federal expenditures were up, and still totals about half of our $14 trillion GDP, even though the federal government borrowed and spent a whopping $1.8 trillion in the last 12 months, which may explain how Total Compensation increased 3.0% in the last year, rising to $8.03 trillion, which seems paradoxical since unemployment, at an “official” 9.8% and (according to John Williams at shadowstats.com) is unofficially 22%, is a Big, Big Problem (BBP).

Even more surprising was that Household Assets increased $1.2 trillion to $68.8 trillion, while Household Liabilities were $13.9 trillion and did not increase much because, I assume, people did not spend a lot of borrowed money in the last quarter.

The report handily subtracts liabilities from assets and concludes that that Household Net Worth increased $1.19 trillion during the third quarter, rising to a surprising $54.9 trillion, which is almost 4 times Liabilities, thus everything should be peachy keen and couldn’t be better except for, you know, that pesky unemployment thing.

If you believe that, then you will not be interested in the Mogambo Big Plan (MBP) to buy gold, silver and oil as protection against the roaring, catastrophic inflation caused by the Federal Reserve creating so much money, and the federal government borrowing it and spending it.

And to tell you the truth, I don’t know whether or not I believe any of it, and I only follow the Mogambo Big Plan (MBP) because it is fool-proof and so easy that I giggle with childish delight, “Whee! This investing stuff is easy!”

The Mogambo Guru

for The Daily Reckoning

Cargo Ships Slowing

These ships are slowing their speed. There is a storm a coming, and it is not weather related.

You may want to look at the chart. Can you say double dip?

And I'm not talking a double dip like this...

http://www.youtube.com/watch?v=YWuSi00CcNk&feature=related

You may want to look at the chart. Can you say double dip?

And I'm not talking a double dip like this...

http://www.youtube.com/watch?v=YWuSi00CcNk&feature=related

Wednesday, December 22, 2010

Tuesday, December 21, 2010

Monday, December 20, 2010

States In Trouble...Say It Isn't So

Now CBS is not what one would call a uh, conservative media outlet. For them to run a piece like this, is almost unheard of.

Pay attention to the video. The States are in trouble. I hope you are not counting on or invested in a State pension or Municipal Bond.

Pay attention to the video. The States are in trouble. I hope you are not counting on or invested in a State pension or Municipal Bond.

Saturday, December 18, 2010

Look Here...

Here are a couple things that should have you concerned....

Federal Government Debt

Federal Surplus or Deficit

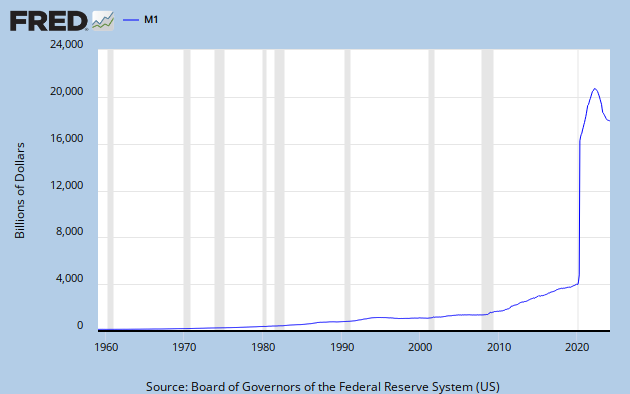

Money Stock (money in ciculation)

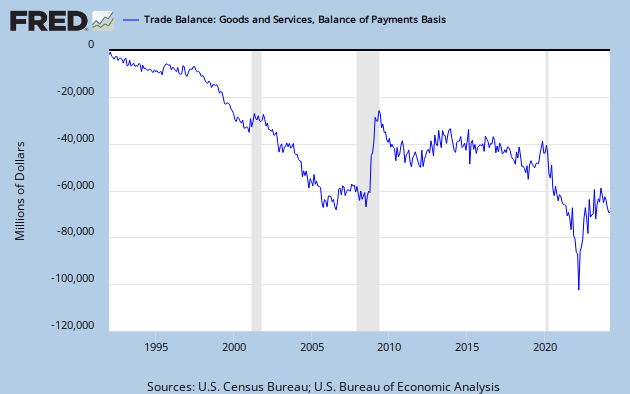

Trade Balance (looks like we are losing about $40 billion a year)

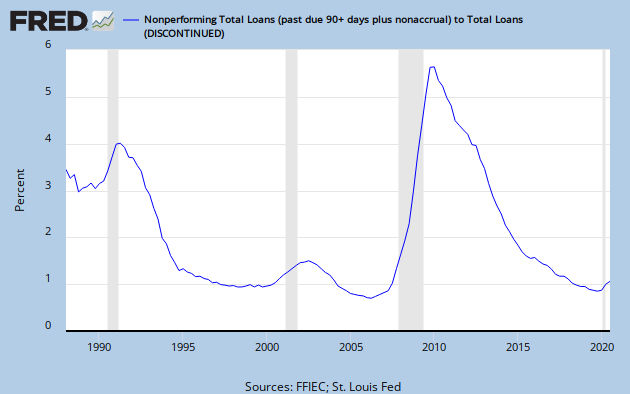

Non performing loans at banks

Makes you say...hmmm.

Keep your eyes open and start preparing.

Are You Ready?

If you haven't been paying attention, this is what is happening around the world.

First Greece....

and Rome....

and more being predicted.

You don't think this can happen here in America? Well, we only have a $14 trillion debt, $1.3 Trillion deficit last year, already $290 billion deficit for the first two months this budget year, States going broke, 47 million people receiving food stamps, corruption in banking and Wall Street, 157 bank failures so far in 2010, $100 trillion in unfunded liabilities, housing prices tanking, inflation occurring, and gold and silver hitting new highs...to name a few. Keep your head buried in the sand or start preparing.

First Greece....

and Rome....

and more being predicted.

You don't think this can happen here in America? Well, we only have a $14 trillion debt, $1.3 Trillion deficit last year, already $290 billion deficit for the first two months this budget year, States going broke, 47 million people receiving food stamps, corruption in banking and Wall Street, 157 bank failures so far in 2010, $100 trillion in unfunded liabilities, housing prices tanking, inflation occurring, and gold and silver hitting new highs...to name a few. Keep your head buried in the sand or start preparing.

Thursday, December 16, 2010

Silver and Gold, Silver and ....

Silver is what JP Morgan is asking for for Christmas. Seems they have been playing a game with us and they are losing. The seem to be a little no a lot short on physical silver. This video explains a lot.

Saturday, December 11, 2010

Hyperinflation May Be Only 6-9 Months Away

John Williams from Shadow Stats was interviewed by Business News Network. Below is the link. It is worth the 10 minutes.

http://watch.bnn.ca/squeezeplay/december-2010/squeezeplay-december-8-2010/#clip386602

http://watch.bnn.ca/squeezeplay/december-2010/squeezeplay-december-8-2010/#clip386602

Friday, December 3, 2010

Unemployment Now 9.8%...Hmmm

The "experts" were predicting that unemployment would go down to about 9.4%. Uh, well it went to 9.8%. This video will answer a few questions.

Sunday, November 21, 2010

Sheeple --- Wake-Up!

When will the sheeple get fed up with what is happening? I hope sooner than later.

Saturday, November 20, 2010

Six More To The Banking Morgue

Tifton Banking Company--Tifton, GA

Copper Star Bank--Scottsdale, AZ

First Banking Center--Burlington, WI

Gulf State Community Bank--Carabelle, FL

Allegiance Bank of North America--Bala Cynwyd, PA

Darby Bank & Trust--Vidalia, GA

Copper Star Bank--Scottsdale, AZ

First Banking Center--Burlington, WI

Gulf State Community Bank--Carabelle, FL

Allegiance Bank of North America--Bala Cynwyd, PA

Darby Bank & Trust--Vidalia, GA

Friday, November 19, 2010

I keep Smelling A Rat(s)

A Closer Look At FDIC Bank Closures

I know, we have been smelling a rat for a while. Well when you examine the bank closures closely the stinch becomes quite strong. The above analysis looked a just 38 banks closed by the FDIC between August 6, 2010, and November 12, 2010. Below is the crux of the article.

In the overwhelming majority of cases (30 closings out of 38), resolution of the failures was accomplished by way of the FDIC entering into loss share agreements covering a high percentage of the assets taken over by the successor banks. In connection with these 30 closings, the FDIC entered into new loss-share agreements covering an additional $8.2 billion in assets.

That brings the total face value of assets covered by FDIC loss share agreements up to about $189 billion. As we have discussed in the past, these loss share agreements typically guarantee at least 80% of the value of assets over a period of eight to ten years.

This is another form of quantitative easing being practiced by the federal government.

Taking the 38 failed banks as a whole, they had declared assets of $13.78 billion and deposits of $11.97 billion. The FDIC estimated the closings cost $2.72 billion, meaning the banks’ assets were really only worth $9.25 billion. Overall, bank management overvalued assets by $4.53 billion, around 49%.

Specific examples were far worse:

Maritime Savings Bank of West Allis, Wisconsin, had stated assets of $350.5 million and deposits of $248.1 million. The FDIC estimated its closing cost $83.6 million. Based on that estimate, the bank’s assets were really only worth $164.5 million, and had been overvalued by 113%.

ShoreBank of Chicago, Illinois, had stated assets of $2.16 billion and deposits of $1.54 billion. The FDIC estimated its closing cost about $370 million. Based on that estimate, the bank’s assets were really only worth about $1.17 billion, and had been overvalued by 84%.

Premier Bank of Jefferson City, Missouri, had stated assets of $1.18 billion and deposits of $1.03 billion. The FDIC estimated its closing cost $407 million. Based on that estimate, the bank’s assets were really only worth $623 million, and had been overvalued by 84%.

K Bank of Randallstown, Maryland, had stated assets of $538.3 million and deposits of $500.1 million. The FDIC estimated its closing cost $198.4 million. Based on that estimate, the bank’s assets were really only worth $301.7 million, and had been overvalued by 78%.

Finally, Horizon Bank of Bradenton, Florida, had stated assets of $187.8 million and deposits of $164.6 million. The FDIC estimated its closing cost $58.9 million. Based on that estimate, the bank’s assets were really only worth $105.7 million, and had been overvalued by 78%.

The FDIC’s closure of 38 banks over three months is by no means an insignificant number. However, in the context of the FDIC’s overhang of troubled banks, it suggests the pace of bank closings is being kept artificially low.

As of April 2010, there were about 425 banks operating under serious FDIC enforcement orders that called into question the banks’ solvency. Since then, upwards of 25 new banks have come under such orders each month.

Therefore, closing 13 banks a month has done nothing to reduce the backlog of troubled banks operating in the Country. That backlog could only have grown.

Most likely, the pace of bank closings had been held back artificially by the need to keep up appearances for the benefit of the mid-term elections. With those now behind us, I would expect the pace of bank closings to accelerate considerably.

Let's keep our eyes on this and see if the closings accelerate.

I know, we have been smelling a rat for a while. Well when you examine the bank closures closely the stinch becomes quite strong. The above analysis looked a just 38 banks closed by the FDIC between August 6, 2010, and November 12, 2010. Below is the crux of the article.

In the overwhelming majority of cases (30 closings out of 38), resolution of the failures was accomplished by way of the FDIC entering into loss share agreements covering a high percentage of the assets taken over by the successor banks. In connection with these 30 closings, the FDIC entered into new loss-share agreements covering an additional $8.2 billion in assets.

That brings the total face value of assets covered by FDIC loss share agreements up to about $189 billion. As we have discussed in the past, these loss share agreements typically guarantee at least 80% of the value of assets over a period of eight to ten years.

This is another form of quantitative easing being practiced by the federal government.

Taking the 38 failed banks as a whole, they had declared assets of $13.78 billion and deposits of $11.97 billion. The FDIC estimated the closings cost $2.72 billion, meaning the banks’ assets were really only worth $9.25 billion. Overall, bank management overvalued assets by $4.53 billion, around 49%.

Specific examples were far worse:

Maritime Savings Bank of West Allis, Wisconsin, had stated assets of $350.5 million and deposits of $248.1 million. The FDIC estimated its closing cost $83.6 million. Based on that estimate, the bank’s assets were really only worth $164.5 million, and had been overvalued by 113%.

ShoreBank of Chicago, Illinois, had stated assets of $2.16 billion and deposits of $1.54 billion. The FDIC estimated its closing cost about $370 million. Based on that estimate, the bank’s assets were really only worth about $1.17 billion, and had been overvalued by 84%.

Premier Bank of Jefferson City, Missouri, had stated assets of $1.18 billion and deposits of $1.03 billion. The FDIC estimated its closing cost $407 million. Based on that estimate, the bank’s assets were really only worth $623 million, and had been overvalued by 84%.

K Bank of Randallstown, Maryland, had stated assets of $538.3 million and deposits of $500.1 million. The FDIC estimated its closing cost $198.4 million. Based on that estimate, the bank’s assets were really only worth $301.7 million, and had been overvalued by 78%.

Finally, Horizon Bank of Bradenton, Florida, had stated assets of $187.8 million and deposits of $164.6 million. The FDIC estimated its closing cost $58.9 million. Based on that estimate, the bank’s assets were really only worth $105.7 million, and had been overvalued by 78%.

The FDIC’s closure of 38 banks over three months is by no means an insignificant number. However, in the context of the FDIC’s overhang of troubled banks, it suggests the pace of bank closings is being kept artificially low.

As of April 2010, there were about 425 banks operating under serious FDIC enforcement orders that called into question the banks’ solvency. Since then, upwards of 25 new banks have come under such orders each month.

Therefore, closing 13 banks a month has done nothing to reduce the backlog of troubled banks operating in the Country. That backlog could only have grown.

Most likely, the pace of bank closings had been held back artificially by the need to keep up appearances for the benefit of the mid-term elections. With those now behind us, I would expect the pace of bank closings to accelerate considerably.

Let's keep our eyes on this and see if the closings accelerate.

Thursday, November 18, 2010

Are You Kidding Me?

http://news.yahoo.com/s/ap/20101117/ap_on_bi_ge/us_fed_stimulus

In the above article, Ben Bernake was quoted as saying the latest QE2 stimulus of $600,000,000,000 will create 700,000 jobs over two years. WOW, that is only $857,142.86 per job created. If it takes that much to create a job, then with about 14 million people that is jobless, we will need about 12 Trillion dollars to put everyone back to work.

Is that a good use of YOUR money?

In the above article, Ben Bernake was quoted as saying the latest QE2 stimulus of $600,000,000,000 will create 700,000 jobs over two years. WOW, that is only $857,142.86 per job created. If it takes that much to create a job, then with about 14 million people that is jobless, we will need about 12 Trillion dollars to put everyone back to work.

Is that a good use of YOUR money?

Wednesday, November 17, 2010

Sunday, November 14, 2010

111 Obamacare Waivers- Hides It on Website

What does Darden, Jack in the Box, Atena, Ruby Tuesday, Dish Network, Cracker Barrel, Service Employees Benefit Fund, New England Health Care, Local 25 SEIU, Cigna, Adventist Care Centers, Assurant Health, Captain Elliot's Party Boats and about 92 other comanies have in comman?

They got a wavier from the ObamaCare Bill. That's right, these companies, well their lawyers, was able to petition OUT of the new and upcoming ObamaCare. Why do they want out you might ask? Because they see that it is an added cost to their companies and they would need to layoff employees.

Folks, ObamaCare is a job killer. The problem is the other smaller companies cannot fight and hence they will be required to comply.

They got a wavier from the ObamaCare Bill. That's right, these companies, well their lawyers, was able to petition OUT of the new and upcoming ObamaCare. Why do they want out you might ask? Because they see that it is an added cost to their companies and they would need to layoff employees.

Folks, ObamaCare is a job killer. The problem is the other smaller companies cannot fight and hence they will be required to comply.

Thursday, November 11, 2010

Video You Should Watch

This gives you a little insight into how the markets can be manipulated by the Fed. It is only 29 minutes long. Take some time and view it.

WHAT Did He Say?

At about 0:13 into the video, you can here him say, "Things were being done which were certainly illegal and clearly criminal in certain cases..."

Alan Greenspan, the former Federal Reserve Chairman tells us there was criminal activity happening, so tell me why there are no bankers wearing the shiney nickel plated handcuffs.

Now go back and watch Ben Bernake, the current Federal Reserve Chairman, when Mr. Greenspan mentioned the "illegal and criminal" words.

Alan Greenspan, the former Federal Reserve Chairman tells us there was criminal activity happening, so tell me why there are no bankers wearing the shiney nickel plated handcuffs.

Now go back and watch Ben Bernake, the current Federal Reserve Chairman, when Mr. Greenspan mentioned the "illegal and criminal" words.

Thursday, November 4, 2010

Quantitative Easing is Economic Suicide

This is a must read article. I will highlight some key parts of it for those that don't want to read the whole article (it's not that long, so just read it).

Quantitative Easing is Economic Suicide.

"Quantitative easing is nothing more than a euphemism for printing money out of thin air. Its one-and-only purpose is to destroy the currency being printed. It is pure dilution and absolutely no different than a corporation vowing to improve its fiscal performance simply by printing a lot of new shares."

"Visit Shadowstats.com, operated by respected U.S. economist John Williams, and you will hear that U.S. inflation has been in the range of 8.5% - 9.5% all this year. Williams performs his calculations using the exact same methodology used by the U.S. government a generation ago, before the U.S. government intentionally incorporated various statistical lies into this measurement."

"Understand the enormous "rewards" which a government receives for lying, by grossly under-stating the rate of inflation. Payouts on $100's of billions of U.S. government benefits per year are indexed to the rate of "official" inflation. By grossly understating inflation (and cheating all of the recipients of those benefits), the U.S. government can get an instant, multibillion dollar windfall from that one lie, alone (every year)."

"Here are the facts. Previously, the U.S. government was able to find (real) buyers for its Treasuries, due to the need of other governments to recirculate/reinvest the money from their trade surpluses and fiscal surpluses. Thanks to the Wall Street-engineered "Crash of '08," the vast majority of those surpluses have disappeared.

At the same time, the U.S. government is cranking out much more "supply" than at any other time in the history of the United States. Thus, we are told by the U.S. government (and the Federal Reserve) that there are more "buyers" for U.S. Treasuries than at any time in history -- despite the fact those buyers have no money. But that is literally less than half of this farce.

Not only are we being told that buyers-with-no-money are purchasing more Treasuries than at any other time in history, we're also told that these buyers are joyfully paying the highest prices in history (by a large margin) for these debt instruments. However this still doesn't capture the absurdity of this scenario.

Buyers-with-no-money are (supposedly) buying far more Treasuries than at any time in history, at the highest prices (by far) -- while publicly, all of these "buyers" are expressing severe doubts about the creditworthiness of the U.S. (i.e. its ability to ever make good on this $trillions in new bond debt). Would any sane individual buy the greatest quantity of anything (at the highest prices in history), while publicly expressing severe doubts about the value/quality of that good?

Don't answer that question yet. Since "quantitative easing" must (and does) destroy the value of a currency, for every 1% the dollar loses in value, all of those $trillions in U.S. Treasuries (which are denominated in U.S. dollars) lose the same amount of their own value.

Thus, with U.S. bond-prices at their highest level in history (and at their maximum, theoretical price), it is 100% inevitable that those prices can only fall. This means that buyers-with-no-money are supposedly buying the most "supply" of Treasuries in history, at the highest prices in history - while being 100% certain of losing money on those Treasuries due to their inevitable fall in price and the loss of value of the U.S. dollar. Clearly, there are few buyers for U.S. Treasuries. Instead, "The Three Amigos" of debt (the U.S., UK and Japan) are playing the bond-market equivalent of musical chairs. The UK "buys" U.S. Treasuries, Japan buys UK debt, and the U.S. government buys Japanese bonds -- and all with the "quantitative easing" funny-money they are printing out of thin air. Then all three governments pretend their bond-auctions are "covered."

This brings us to the final element of this charade: U.S. bond market "auctions." At the same time that the U.S. government reported the "economic miracle" of buyers-with-no-money buying more of something they don't want (at the highest prices), just so they can lose money, the U.S. government removed all "transparency" from these bond-auctions. Even bond traders with decades of experience report that they have no idea of who is actually buying these bonds. This is like an amateur magician who is so clumsy in performing his magic that he needs to turn out the lights while executing his tricks so that the audience doesn't immediately spot the ineptitude of his fraud."

"Why has the Federal Reserve been so adamant about fraudulently concealing its actions in the U.S. bond-market, and the quantitative easing that makes that fraud possible? First, in printing up money, but not acknowledging it, the Federal Reserve is literally counterfeiting trillions of dollars of U.S. currency."

"With the obvious fact that the U.S. government never stopped its quantitative easing, this brings us to the current scenario. The entire reason why the Fed is "announcing" something which it is already doing is because even doctored U.S. government statistics can't hide the fact that the U.S. economy is once again collapsing.

Obviously, quantitative easing is not, does not, and cannot "fix" any of the U.S. economy's problems, which (ironically) have all been caused by too much new debt, and new money-printing. So why is the Fed "coming out of the closet" (even just temporarily)? Simply, with the intensifying weakness of the U.S. economy, the Federal Reserve (and the U.S. government) feel an intense need to be seen to be "doing something" (even something it was already doing) -- and neither the U.S. government nor the Fed have any other ideas."

People, it is time to get out of the dollar and into tangibles. If you have not thought about gold or silver, it is past time. Even though gold and silver have increased, I don't think we are anywhere near the top, so you still have time. (I am not a financial advisor, so do your own research and invest as you feel comfortable).

Get prepared, more inflation is on it's way (maybe even hyperinflation).

Quantitative Easing is Economic Suicide.

"Quantitative easing is nothing more than a euphemism for printing money out of thin air. Its one-and-only purpose is to destroy the currency being printed. It is pure dilution and absolutely no different than a corporation vowing to improve its fiscal performance simply by printing a lot of new shares."

"Visit Shadowstats.com, operated by respected U.S. economist John Williams, and you will hear that U.S. inflation has been in the range of 8.5% - 9.5% all this year. Williams performs his calculations using the exact same methodology used by the U.S. government a generation ago, before the U.S. government intentionally incorporated various statistical lies into this measurement."

"Understand the enormous "rewards" which a government receives for lying, by grossly under-stating the rate of inflation. Payouts on $100's of billions of U.S. government benefits per year are indexed to the rate of "official" inflation. By grossly understating inflation (and cheating all of the recipients of those benefits), the U.S. government can get an instant, multibillion dollar windfall from that one lie, alone (every year)."

"Here are the facts. Previously, the U.S. government was able to find (real) buyers for its Treasuries, due to the need of other governments to recirculate/reinvest the money from their trade surpluses and fiscal surpluses. Thanks to the Wall Street-engineered "Crash of '08," the vast majority of those surpluses have disappeared.

At the same time, the U.S. government is cranking out much more "supply" than at any other time in the history of the United States. Thus, we are told by the U.S. government (and the Federal Reserve) that there are more "buyers" for U.S. Treasuries than at any time in history -- despite the fact those buyers have no money. But that is literally less than half of this farce.

Not only are we being told that buyers-with-no-money are purchasing more Treasuries than at any other time in history, we're also told that these buyers are joyfully paying the highest prices in history (by a large margin) for these debt instruments. However this still doesn't capture the absurdity of this scenario.

Buyers-with-no-money are (supposedly) buying far more Treasuries than at any time in history, at the highest prices (by far) -- while publicly, all of these "buyers" are expressing severe doubts about the creditworthiness of the U.S. (i.e. its ability to ever make good on this $trillions in new bond debt). Would any sane individual buy the greatest quantity of anything (at the highest prices in history), while publicly expressing severe doubts about the value/quality of that good?

Don't answer that question yet. Since "quantitative easing" must (and does) destroy the value of a currency, for every 1% the dollar loses in value, all of those $trillions in U.S. Treasuries (which are denominated in U.S. dollars) lose the same amount of their own value.

Thus, with U.S. bond-prices at their highest level in history (and at their maximum, theoretical price), it is 100% inevitable that those prices can only fall. This means that buyers-with-no-money are supposedly buying the most "supply" of Treasuries in history, at the highest prices in history - while being 100% certain of losing money on those Treasuries due to their inevitable fall in price and the loss of value of the U.S. dollar. Clearly, there are few buyers for U.S. Treasuries. Instead, "The Three Amigos" of debt (the U.S., UK and Japan) are playing the bond-market equivalent of musical chairs. The UK "buys" U.S. Treasuries, Japan buys UK debt, and the U.S. government buys Japanese bonds -- and all with the "quantitative easing" funny-money they are printing out of thin air. Then all three governments pretend their bond-auctions are "covered."

This brings us to the final element of this charade: U.S. bond market "auctions." At the same time that the U.S. government reported the "economic miracle" of buyers-with-no-money buying more of something they don't want (at the highest prices), just so they can lose money, the U.S. government removed all "transparency" from these bond-auctions. Even bond traders with decades of experience report that they have no idea of who is actually buying these bonds. This is like an amateur magician who is so clumsy in performing his magic that he needs to turn out the lights while executing his tricks so that the audience doesn't immediately spot the ineptitude of his fraud."

"Why has the Federal Reserve been so adamant about fraudulently concealing its actions in the U.S. bond-market, and the quantitative easing that makes that fraud possible? First, in printing up money, but not acknowledging it, the Federal Reserve is literally counterfeiting trillions of dollars of U.S. currency."

"With the obvious fact that the U.S. government never stopped its quantitative easing, this brings us to the current scenario. The entire reason why the Fed is "announcing" something which it is already doing is because even doctored U.S. government statistics can't hide the fact that the U.S. economy is once again collapsing.

Obviously, quantitative easing is not, does not, and cannot "fix" any of the U.S. economy's problems, which (ironically) have all been caused by too much new debt, and new money-printing. So why is the Fed "coming out of the closet" (even just temporarily)? Simply, with the intensifying weakness of the U.S. economy, the Federal Reserve (and the U.S. government) feel an intense need to be seen to be "doing something" (even something it was already doing) -- and neither the U.S. government nor the Fed have any other ideas."

People, it is time to get out of the dollar and into tangibles. If you have not thought about gold or silver, it is past time. Even though gold and silver have increased, I don't think we are anywhere near the top, so you still have time. (I am not a financial advisor, so do your own research and invest as you feel comfortable).

Get prepared, more inflation is on it's way (maybe even hyperinflation).

Tuesday, October 19, 2010

America In Decline...

Is our country in a decline? Well we have a government that continues to add debt, our trade deficits are horrible and the great USA does not manufacture. The Tout TV says all is well, just look at the stock market. I would refer you to the stock market of Zimbabwe. Their stock exchange is up, but so is their inflation rate , which back at the end of 2008 the Annual Inflation Rate was 516 Quintillion Per Cent. How many zero's is that? My point is we cannot look at the our stock market as an indicator of how the economy is doing.

Here are some shocking statistics.

For American manufacturers, the bad years didn't begin with the banking crisis of 2008. Indeed, the U.S. manufacturing sector never emerged from the 2001 recession, which coincided with China's entry into the World Trade Organization. Since 2001, the country has lost 42,400 factories, including 36 percent of factories that employ more than 1,000 workers (which declined from 1,479 to 947), and 38 percent of factories that employ between 500 and 999 employees (from 3,198 to 1,972). An additional 90,000 manufacturing companies are now at risk of going out of business....Manufacturing employment dropped to 11.7 million in October 2009, a loss of 5.5 million or 32 percent of all manufacturing jobs since October 2000. The last time fewer than 12 million people worked in the manufacturing sector was in 1941. (I would remind you what happened in 1941...Pearl Harbor and the America's entry into WWII.)

If you are wondering what kind of manufacturing plants have closed let me ask you who is manufacturing televisions or cameras here in the U.S.? Where is Kodak, Magnavox, etc.?

When Jimmy Carter was urging energy conservation in 1980, the United States imported 37 percent of oil consumed, now we are at 58%. A 64% increase in 30 years.

The U.S. Commerce Department recently announced that the U.S. trade deficit increased by 18.8% in June to $49.9 billion. Most analysts had expected the figure to be somewhere around 41 to 43 billion dollars. In the month of June, imports rose to approximately $200 billion while exports fell to about $150 billion. (How do we survive as a nation if we continue to lose $1 Trillion to other nations every 20 months? This is money that we never see again.)

Total US government spending is 36.2% of GDP.

America's current problem with immigration is a direct byproduct of NAFTA. The amount of immigrants entering the U.S. illegally has more than tripled since 1993, rising from less than four million to over 12 million. Furthermore, since the implementation of NAFTA 300,000 farms have gone out of business and average wages have dropped 13 percent.....Before NAFTA was signed the United States actually traded at a surplus with Mexico. By 2007, a year before the financial collapse, that balance had more than reversed, it had completely imploded. A mere 14 years after signing NAFTA, a small surplus turned into a $91 billion deficit. Factor in Canada and our deficit sat at $191 billion.

If you bought a $20 item in 1913, that same item would cost you $61.82 in 1963 and would be $441 today! (Inflation is a hidden tax.)

Folks, we need to see the writing on the wall. If we keep denying the facts that America is in a decline we will continue to procede to a Second and maybe over time a Third world country. Pass this along to your friends and family as this news needs to get out.

Keep your eyes open...

Here are some shocking statistics.

For American manufacturers, the bad years didn't begin with the banking crisis of 2008. Indeed, the U.S. manufacturing sector never emerged from the 2001 recession, which coincided with China's entry into the World Trade Organization. Since 2001, the country has lost 42,400 factories, including 36 percent of factories that employ more than 1,000 workers (which declined from 1,479 to 947), and 38 percent of factories that employ between 500 and 999 employees (from 3,198 to 1,972). An additional 90,000 manufacturing companies are now at risk of going out of business....Manufacturing employment dropped to 11.7 million in October 2009, a loss of 5.5 million or 32 percent of all manufacturing jobs since October 2000. The last time fewer than 12 million people worked in the manufacturing sector was in 1941. (I would remind you what happened in 1941...Pearl Harbor and the America's entry into WWII.)

If you are wondering what kind of manufacturing plants have closed let me ask you who is manufacturing televisions or cameras here in the U.S.? Where is Kodak, Magnavox, etc.?

When Jimmy Carter was urging energy conservation in 1980, the United States imported 37 percent of oil consumed, now we are at 58%. A 64% increase in 30 years.

The U.S. Commerce Department recently announced that the U.S. trade deficit increased by 18.8% in June to $49.9 billion. Most analysts had expected the figure to be somewhere around 41 to 43 billion dollars. In the month of June, imports rose to approximately $200 billion while exports fell to about $150 billion. (How do we survive as a nation if we continue to lose $1 Trillion to other nations every 20 months? This is money that we never see again.)

Total US government spending is 36.2% of GDP.

America's current problem with immigration is a direct byproduct of NAFTA. The amount of immigrants entering the U.S. illegally has more than tripled since 1993, rising from less than four million to over 12 million. Furthermore, since the implementation of NAFTA 300,000 farms have gone out of business and average wages have dropped 13 percent.....Before NAFTA was signed the United States actually traded at a surplus with Mexico. By 2007, a year before the financial collapse, that balance had more than reversed, it had completely imploded. A mere 14 years after signing NAFTA, a small surplus turned into a $91 billion deficit. Factor in Canada and our deficit sat at $191 billion.

U.S debt to rise to $19.6 trillion by 2015.

The government is effectively bankrupt. Using GAAP accounting principles, the annual deficit is running in the range of $4 trillion to $5 trillion. That's beyond containment. The government can't cover it with taxes. They'd still be in deficit if they took 100% of personal income and corporate profits. They'd also still be in deficit if they cut every penny of government spending except for Social Security and Medicare. Washington lacks the will to slash its social programs severely, to change its approach to ever bigger government. The only option left going forward is for the government eventually to print the money for the obligations it cannot otherwise cover, which sets up a hyperinflation.If you bought a $20 item in 1913, that same item would cost you $61.82 in 1963 and would be $441 today! (Inflation is a hidden tax.)

Folks, we need to see the writing on the wall. If we keep denying the facts that America is in a decline we will continue to procede to a Second and maybe over time a Third world country. Pass this along to your friends and family as this news needs to get out.

Keep your eyes open...

Sunday, October 17, 2010

U.S. Loses AAA Rating

Debt market strips U.S. of triple-A rating.

That puts the United States' third-quarter performance behind only two other nations, both of which are struggling with the early stages of sovereign debt crises: Ireland, whose CDS prices rocketed 72% to a record amid growing questions about the costs of a massive bank bailout, and Portugal, whose costs jumped 30%.

I'm not a financial planner or an economist, but this doesn't sound good to me. Not just the AAA rating being taken away, but look what company we are in...Ireland and Portugal who are near default.

That puts the United States' third-quarter performance behind only two other nations, both of which are struggling with the early stages of sovereign debt crises: Ireland, whose CDS prices rocketed 72% to a record amid growing questions about the costs of a massive bank bailout, and Portugal, whose costs jumped 30%.

I'm not a financial planner or an economist, but this doesn't sound good to me. Not just the AAA rating being taken away, but look what company we are in...Ireland and Portugal who are near default.

October....Halloween May Be Coming Soon

The Real Horror Story: The U.S. Economic Meltdown

Let me point out a few of the key points this author is making. Reading the entire article is prudent.

The mainstream media has been treating "Foreclosuregate" as if it is a minor nuisance, but the truth is that the lid is about to be publicly lifted on years and years of massive fraud in the U.S. mortgage industry, and this thing has the potential to cause economic chaos that is absolutely unprecedented. Over the past several days, expert after expert has been coming forward and warning that this crisis could completely and totally paralyze the mortgage industry in the United States. If that happens, it will be essentially like pulling the plug on the U.S. economic recovery.

According to the U.S. Census Bureau, the U.S. trade deficit was $46.3 billion during August, which was up significantly from $42.6 billion in July.

So how much coverage did this get in the mainstream media?

Well, just about none.

How long do you think that the U.S. economy can keep shelling out 40 or 50 billion more dollars than we take in every single month?

According to the Department of Labor, for the week ending October 9th the advance figure for seasonally adjusted initial jobless claims was 462,000, which represented an increase of 13,000 from the previous week.

We have an unemployment epidemic going on in this country, but what did the mainstream media do in response to this news?

They yawned. Instead, many of the "financial experts" were busy talking about how wonderful it is that the Stock Market is going up, up, up.

Well, as one reader recently reminded me, if you want to evaluate an economy by how much the stock market is going up, then the economy of Zimbabwe has had an absolutely wonderful decade!

Yet another piece of really bad economic news that just came out is that the number of home repossessions by banks set a new all-time record during the month of September. The record total of 102,134 bank repossessions was the first time ever that bank repossessions climbed over the 100,000 mark for a single month.

The good news is that bank repossessions are about to come to a screeching halt.

The bad news is that it is because the U.S. mortgage industry is about to become completely and totally paralyzed by this foreclosure fraud crisis.

The legal rights to millions of U.S. mortgages has been scrambled so badly that it might actually be impossible to fully sort this mess out. In particular, MERS (Mortgage Electronic Registration Systems) has created a paperwork nightmare that may never be able to be completely remediated.

Meanwhile, virtually nobody will want to buy any house that has been foreclosed on in the past ten years or so until this mess is sorted out (which could take years and years).

Meanwhile, title insurance companies are going to avoid foreclosures like the plague.

Meanwhile, all of the investors that have been propping up the housing market by buying foreclosures are going to be fleeing the market in droves.

Meanwhile, the financial world is going to be trying to figure out which U.S. lending institutions are still solvent. The value of most mortgage-based assets is now totally up in the air.

Meanwhile, millions more homeowners across the United States will be emboldened to quit making payments on their mortgages as they realize that those holding their mortgages may not have the legal right to foreclose on them.

And that is where the true horror of this entire situation may lie. What is going to happen if millions upon millions of Americans holding underwater mortgages look at this situation and decide that they really don't have to be afraid of the threat of foreclosure any longer?

If a massive wave of homeowners suddenly decides to simply quit paying their mortgages, it would basically wipe out nearly the entire mortgage industry.

Keep your eyes open....

Let me point out a few of the key points this author is making. Reading the entire article is prudent.

The mainstream media has been treating "Foreclosuregate" as if it is a minor nuisance, but the truth is that the lid is about to be publicly lifted on years and years of massive fraud in the U.S. mortgage industry, and this thing has the potential to cause economic chaos that is absolutely unprecedented. Over the past several days, expert after expert has been coming forward and warning that this crisis could completely and totally paralyze the mortgage industry in the United States. If that happens, it will be essentially like pulling the plug on the U.S. economic recovery.

According to the U.S. Census Bureau, the U.S. trade deficit was $46.3 billion during August, which was up significantly from $42.6 billion in July.

So how much coverage did this get in the mainstream media?

Well, just about none.

How long do you think that the U.S. economy can keep shelling out 40 or 50 billion more dollars than we take in every single month?

According to the Department of Labor, for the week ending October 9th the advance figure for seasonally adjusted initial jobless claims was 462,000, which represented an increase of 13,000 from the previous week.

We have an unemployment epidemic going on in this country, but what did the mainstream media do in response to this news?

They yawned. Instead, many of the "financial experts" were busy talking about how wonderful it is that the Stock Market is going up, up, up.

Well, as one reader recently reminded me, if you want to evaluate an economy by how much the stock market is going up, then the economy of Zimbabwe has had an absolutely wonderful decade!

Yet another piece of really bad economic news that just came out is that the number of home repossessions by banks set a new all-time record during the month of September. The record total of 102,134 bank repossessions was the first time ever that bank repossessions climbed over the 100,000 mark for a single month.

The good news is that bank repossessions are about to come to a screeching halt.

The bad news is that it is because the U.S. mortgage industry is about to become completely and totally paralyzed by this foreclosure fraud crisis.

The legal rights to millions of U.S. mortgages has been scrambled so badly that it might actually be impossible to fully sort this mess out. In particular, MERS (Mortgage Electronic Registration Systems) has created a paperwork nightmare that may never be able to be completely remediated.

Meanwhile, virtually nobody will want to buy any house that has been foreclosed on in the past ten years or so until this mess is sorted out (which could take years and years).

Meanwhile, title insurance companies are going to avoid foreclosures like the plague.

Meanwhile, all of the investors that have been propping up the housing market by buying foreclosures are going to be fleeing the market in droves.

Meanwhile, the financial world is going to be trying to figure out which U.S. lending institutions are still solvent. The value of most mortgage-based assets is now totally up in the air.

Meanwhile, millions more homeowners across the United States will be emboldened to quit making payments on their mortgages as they realize that those holding their mortgages may not have the legal right to foreclose on them.

And that is where the true horror of this entire situation may lie. What is going to happen if millions upon millions of Americans holding underwater mortgages look at this situation and decide that they really don't have to be afraid of the threat of foreclosure any longer?

If a massive wave of homeowners suddenly decides to simply quit paying their mortgages, it would basically wipe out nearly the entire mortgage industry.

Keep your eyes open....

Sunday, October 3, 2010

More Evidence Time Is Running Out

To try and convice those that may scoff at my last post, I spent the last couple hours trying to find more evidence that we are in, not heading into, but actually in troubled times.

1. September has seen a stock rally especially with the poverty rate a a 15 year high. Could this be just another bubble? Look at the volume as it has been down by about 50%, which would make it easier to be manipulated.

2. Food stamp use hitting a new high each month for the last 18 months

3. Consumer credit down monthly for the last 23 months.

4. Thirty-four states with drop in hosehold income.

5. Now we have Credit Union bailouts.

6. Foreign Central Banks Net Sellers Of US Agency Debt.

7. Now trade wars with China? http://www.reuters.com/article/idUSTRE68L5K120100924

http://www.cnbc.com/id/39342833

Who do you think wins this one since most everything we buy says "Made in China"?

http://www.telegraph.co.uk/finance/markets/2813630/China-threatens-nuclear-option-of-dollar-sales.html

8. Asia central banks buying up gold.

Any more needed?

Keep your eyes WIDE open and get started.

1. September has seen a stock rally especially with the poverty rate a a 15 year high. Could this be just another bubble? Look at the volume as it has been down by about 50%, which would make it easier to be manipulated.

2. Food stamp use hitting a new high each month for the last 18 months

3. Consumer credit down monthly for the last 23 months.

4. Thirty-four states with drop in hosehold income.

5. Now we have Credit Union bailouts.

6. Foreign Central Banks Net Sellers Of US Agency Debt.

7. Now trade wars with China? http://www.reuters.com/article/idUSTRE68L5K120100924

http://www.cnbc.com/id/39342833

Who do you think wins this one since most everything we buy says "Made in China"?

http://www.telegraph.co.uk/finance/markets/2813630/China-threatens-nuclear-option-of-dollar-sales.html

8. Asia central banks buying up gold.

Any more needed?

Keep your eyes WIDE open and get started.

Saturday, October 2, 2010

Time is running out

I have not been writing much lately as I have been spending time helping a friend as a moderator on his Survival and Preparedness Forum. If you have decided to start preparing, but are unaware of how or where to start, then this is a great place as there are many helpful people and moderators there.

In this blog, I am posting some things that I have noticed since my last post. These are what I would consider warning signs. There are many more, but I don't have the time to post them all. If you notice, they are not from "right wing media" or "gloom and doom sites". If you want more, let me know and I'll post some others.

1. The world and America are becoming more volatile. Even the United Nations is warning the global employment crisis will stir social unrest. Look at what is happening in other parts of the world.

2. Quantitative Easing 2 (QE2) is right around the corner and there is possibly a chance that QE2 could equal $1 trillion. This I believe will put a nail in our coffin. We cannot absorb another $1 trillion in debt. They have already started QE2 to a tune of $27 Billion thus far. The Fed is prepping for more easing.

3. U.S. dollar is `One Step Nearer' to crisis as debt level climbs. The dollar index is dipping nearer to the 72 level. Look at what the dollar index has been doing over the last year.

4. If you haven't noticed, Gold has reached a high of $1322 and Silver is over $22. You may want to look at investing some in precious metals. As all investing opportunites, you should monitor your investments closely. When investors, and countries, want to seek a safe haven they buy precious metals. Whan the dollar loses value, gold and silver prices increases.

My advice to everyone is to start prepping . If you are new to prepping, go visit Survival and Preparedness Forum and start learning. It is not hard and if done right, not expensive. You need to seek out "like minded" individuals as well and start learning together.

. If you are new to prepping, go visit Survival and Preparedness Forum and start learning. It is not hard and if done right, not expensive. You need to seek out "like minded" individuals as well and start learning together.

I have only posted a few things, but there are many more. We could talk about inflation, deflation, Federal Unfunded Liabilites, Cap and Trade, Failed banks, and Bailouts to name a few.

YOU may not get any more warnings. The warnings are here. It is time YOU pay attention and act.

In this blog, I am posting some things that I have noticed since my last post. These are what I would consider warning signs. There are many more, but I don't have the time to post them all. If you notice, they are not from "right wing media" or "gloom and doom sites". If you want more, let me know and I'll post some others.

1. The world and America are becoming more volatile. Even the United Nations is warning the global employment crisis will stir social unrest. Look at what is happening in other parts of the world.

2. Quantitative Easing 2 (QE2) is right around the corner and there is possibly a chance that QE2 could equal $1 trillion. This I believe will put a nail in our coffin. We cannot absorb another $1 trillion in debt. They have already started QE2 to a tune of $27 Billion thus far. The Fed is prepping for more easing.

3. U.S. dollar is `One Step Nearer' to crisis as debt level climbs. The dollar index is dipping nearer to the 72 level. Look at what the dollar index has been doing over the last year.

4. If you haven't noticed, Gold has reached a high of $1322 and Silver is over $22. You may want to look at investing some in precious metals. As all investing opportunites, you should monitor your investments closely. When investors, and countries, want to seek a safe haven they buy precious metals. Whan the dollar loses value, gold and silver prices increases.

My advice to everyone is to start prepping

I have only posted a few things, but there are many more. We could talk about inflation, deflation, Federal Unfunded Liabilites, Cap and Trade, Failed banks, and Bailouts to name a few.

YOU may not get any more warnings. The warnings are here. It is time YOU pay attention and act.

Friday, September 10, 2010

Charlie Crist Ad---Best of Both and Worst of Both

You have to watch both ads, kinda funny.

"Best of Both"

"Worst of Both"

"Best of Both"

"Worst of Both"

Gov. Christie Answers Questions

A teacher from New Jersey had her "lunch" handed to her by Gov. Christie. He told her the actual truth, not the "sories" her union leaders have been feeding her. It is about time that people wake up and see what is happening around them.

It get interesting around 1:24, but continue watching past that and see how he explains things in detail to her.

It get interesting around 1:24, but continue watching past that and see how he explains things in detail to her.

Monday, September 6, 2010

Mandatory IRA's For All?

In doing research for my last post, I came upon this. Senate Bill 3760 proposed by Senators Jeff Bingaman (D-NM) and John Kerry (D-MA.). This bill proposes to established mandatory automatic IRAs for full-time workers who are not covered by company retirement programs. This will require employers to take 3% from your compensation and put into a government run "retirement" program.

There is alot of wherefor's and whatnot's in the legalize writing but this one caught my eye...

‘(B) AUTHORITY OF SECRETARY TO PROVIDE FOR PERIODIC INCREASES- In the case of qualifying employees under an automatic IRA arrangement for 2 or more consecutive years, the Secretary may by regulation provide for periodic (not more frequent than annual) increases in the percentage of compensation an employee is deemed to have elected under subparagraph (A).

So let me work something out. If a lower income employee is making $8.00 and hour and works 40 hours per week and works 51 weeks per year he will earn $16,320 in a year before FDIC and SS. The government will then require him to pay 3% or $489.60 (let's round up to $500) towards his "retirement". I propose the questions...will it really help him in the future, and will he have it waiting on him or will it be like the bankrupt Social Security?

There is alot of wherefor's and whatnot's in the legalize writing but this one caught my eye...

‘(B) AUTHORITY OF SECRETARY TO PROVIDE FOR PERIODIC INCREASES- In the case of qualifying employees under an automatic IRA arrangement for 2 or more consecutive years, the Secretary may by regulation provide for periodic (not more frequent than annual) increases in the percentage of compensation an employee is deemed to have elected under subparagraph (A).

So let me work something out. If a lower income employee is making $8.00 and hour and works 40 hours per week and works 51 weeks per year he will earn $16,320 in a year before FDIC and SS. The government will then require him to pay 3% or $489.60 (let's round up to $500) towards his "retirement". I propose the questions...will it really help him in the future, and will he have it waiting on him or will it be like the bankrupt Social Security?

Watch Your IRA's and 401k's

The Fed is calling for hearings on Sept. 14-15, 2010 to see if they would like to confiscate some of our pension plans. The hearings are being conducted by U. S. Department of Labor’s Employee Benefits Security Administration (EBSA). Of course, they won't use the "confiscate" term so they use the term " lifetime income options for retirement plans".

I had read a few months ago that this was going to be an option put forth, but I blew it off as it just didn't seem possible. To me it seemed to much of a "tin-foil hat" kind of thing. I said to myself, "who in their right mind would turn over some or all of their retirement monies to the government?" Well after seeing this article and the term they used, "lifetime income options for retirement plans", I can see them putting a "spin" on this that the sheeple will buy into.

Remember that there is almost $6 trillion of assests in IRA's and 401k's at the end of 2008, according to The Investment Company Institute. Of course the government could not just come and confiscate our funds, well they could but they won't as that would lead to quite a rebellion. What I would guess they will do is try and take a little at a time, over time. They may start small and "require us" or we would "volunteer" to buy into some sort of government run pension plan or government annuity. CONgress would then pass a bill that the amount we would have to own would increase over time until the government would be the sole provider of pension plans (let's call it govpension). These plans would have the employer take a certain amount, let's say 3% of our pay, and put it into this govpension. If we wanted to save 10% of our income then we could invest the other 7% wherever we want. Over time though the employers will be required to take more and more until the government has what they need, as this will become just another slushfund!

Don't think this can happen? Well look at your paycheck. The government already mandates your employer to withhold FICA taxes, Social Security, etc. In fact, wasn't Social Security originally set up to be our "retirement program?" See The term, in everyday speech, is used to refer only to the benefits for retirement, disability, survivorship, and death. What happens to all the money you have invested into the govpension when you die...the same thing that happens now to your SS benefits when you die...the government keeps most of them, not your family.

This isn't new, look at this article from NASDAQ in January 2010...Obama Administration Mulls Creating Retirement-Savings Bond . Here are some quotes from the article in case you don't want to read it all.

Representatives of the financial-services industry have remained neutral on President Obama's proposal to mandate payroll-deposit Individual Retirement Accounts for workers, but many support the idea of a federal retirement bond as a low-cost investment product. The industry has proposed that the U.S. Treasury Department manage the retirement bonds, similar to the way the agency manages Treasury savings bonds.

President Obama proposed creation of an auto-IRA system in his fiscal-2010 budget, but it lacked specifies regarding how the system would be structured.

Can you imagine what kind of mis-management there would be with this GIGANTIC slushfund for CONgress to have access to!!

People, we need to watch this meeting closely as we may be losing what little we have saved. If this goes through, whatever the shape or form it takes, you can bet it won't be in the interest of "we the people."

I had read a few months ago that this was going to be an option put forth, but I blew it off as it just didn't seem possible. To me it seemed to much of a "tin-foil hat" kind of thing. I said to myself, "who in their right mind would turn over some or all of their retirement monies to the government?" Well after seeing this article and the term they used, "lifetime income options for retirement plans", I can see them putting a "spin" on this that the sheeple will buy into.

Remember that there is almost $6 trillion of assests in IRA's and 401k's at the end of 2008, according to The Investment Company Institute. Of course the government could not just come and confiscate our funds, well they could but they won't as that would lead to quite a rebellion. What I would guess they will do is try and take a little at a time, over time. They may start small and "require us" or we would "volunteer" to buy into some sort of government run pension plan or government annuity. CONgress would then pass a bill that the amount we would have to own would increase over time until the government would be the sole provider of pension plans (let's call it govpension). These plans would have the employer take a certain amount, let's say 3% of our pay, and put it into this govpension. If we wanted to save 10% of our income then we could invest the other 7% wherever we want. Over time though the employers will be required to take more and more until the government has what they need, as this will become just another slushfund!

Don't think this can happen? Well look at your paycheck. The government already mandates your employer to withhold FICA taxes, Social Security, etc. In fact, wasn't Social Security originally set up to be our "retirement program?" See The term, in everyday speech, is used to refer only to the benefits for retirement, disability, survivorship, and death. What happens to all the money you have invested into the govpension when you die...the same thing that happens now to your SS benefits when you die...the government keeps most of them, not your family.

This isn't new, look at this article from NASDAQ in January 2010...Obama Administration Mulls Creating Retirement-Savings Bond . Here are some quotes from the article in case you don't want to read it all.

Representatives of the financial-services industry have remained neutral on President Obama's proposal to mandate payroll-deposit Individual Retirement Accounts for workers, but many support the idea of a federal retirement bond as a low-cost investment product. The industry has proposed that the U.S. Treasury Department manage the retirement bonds, similar to the way the agency manages Treasury savings bonds.

President Obama proposed creation of an auto-IRA system in his fiscal-2010 budget, but it lacked specifies regarding how the system would be structured.

Can you imagine what kind of mis-management there would be with this GIGANTIC slushfund for CONgress to have access to!!

People, we need to watch this meeting closely as we may be losing what little we have saved. If this goes through, whatever the shape or form it takes, you can bet it won't be in the interest of "we the people."

Saturday, September 4, 2010

Bank Failures Thus Far

Here is a comprehensive list of failed banks for 2008, 2009 and 2010. Enjoy!

Failed Bank List

Date Name of bank Assets City State Acquired by FDIC cost

8/20/10 Sonoma Valley Bank $337.1 million Sonoma Calif. Westamerica Bank $10.1 million

8/20/10 Los Padres Bank $870.4 million Solvang Calif. Pacific Western Bank $8.7 million

8/20/10 Butte Community Bank $498.8 million Chico Calif. Rabobank, National Association $17.4 million

8/20/10 Pacific State Bank $312.1 million Stockton Calif. Rabobank, National Association $32.6 million

8/20/10 ShoreBank $2,160 million Chicago Ill. Urban Partnership Bank $367.7 million

8/20/10 Imperial Savings and Loan Association $9.4 million Martinsville Va. River Community Bank, N.A. $3.5 million

8/20/10 Independent National Bank $156.2 million Ocala Fla. CenterState Bank of Florida, N.A. $10.3 million

8/20/10 Community National Bank at Bartow $67.9 million Bartow Fla. CenterState Bank of Florida, N.A. $23.2 million

8/13/10 Palos Bank and Trust Company $493.4 million Palos Heights Ill. First Midwest Bank $72 million

8/6/10 Ravenswood Bank $264.6 million Chicago Ill. Northbrook Bank and Trust Company $68.1 million

7/30/10 LibertyBank $768.2 million Eugene Ore. Home Federal Bank $115.3 million

7/30/10 The Cowlitz Bank $529.3 million Longview Wash. Heritage Bank $160.9 million

7/30/10 Coastal Community Bank $372.9 million Panama City Beach Fla. Centennial Bank $94.5 million

7/30/10 Bayside Savings Bank $66.1 million Port Sainte Joe Fla. Centennial Bank $16.2 million

7/30/10 Northwest Bank & Trust $167.7 million Acworth Ga. State Bank and Trust Company $39.8 million

7/30/10 Home Valley Bank $251.8 million Cave Junction Ore. South Valley Bank & Trust $37.1 million

7/30/10 SouthwestUSA Bank $214 million Las Vegas NV Plaza Bank $74.1 million

7/23/10 Community Security Bank $108 million New Prague Minn. Roundbank $18.6 million

7/23/10 Thunder Bank $32.6 million Sylvan Grove KS The Bennington State Bank $4.5 million

7/23/10 Williamsburg First National Bank $139.3 million Kingstree SC First Citizens Bank and Trust Company, Inc. $8.8 million

7/23/10 Crescent Bank and Trust Company $1.01 billion Jasper GA Renasant Bank $242.4 million

7/23/10 Sterling Bank $407.9 million Lantana FL IBERIABANK $45.5 million

7/16/10 Mainstreet Savings Bank, FSB $97.4 million Hastings Mich. Commercial Bank $11.4 million

7/16/10 Olde Cypress Community Bank $168.7 million Clewiston Fla. CenterState Bank of Florida, N.A. $128.2 million

7/16/10 Turnberry Bank $263.9 million Aventura Fla. NAFH National Bank $34.4 million

7/16/10 Metro Bank of Dade County $442.3 million Miami Fla. NAFH National Bank $67.6 million

7/16/10 First National Bank of the South $682 million Spartanburg S.C. NAFH National Bank $74.9 million

7/16/10 Woodlands Bank $376.2 million Bluffton S.C. Bank of the Ozarks $115 million

7/9/10 Home National Bank $644.50 million Blackwell Okla. RCB Bank $78.70 million

7/9/10 USA Bank $193.30 million Port Chester N.Y. Customer's 1st Bank $61.70 million

7/9/10 Ideal Federal Savings Bank $6.30 million Baltimore Md. no buyer $2.10 million

7/9/10 Bay National Bank $282.20 million Baltimore Md. Bay Bank, FSB $17.40 million

6/25/10 High Desert State Bank $80.30 million Albuquerque N.M. First American Bank $20.90 million

6/25/10 First National Bank $252.50 million Savannah Ga. The Savannah Bank, N.A. $68.90 million

6/25/10 Peninsula Bank $644.30 million Englewood Ill. Premier American Bank $194.80 million

6/18/10 Nevada Security Bank $480.30 million Reno Nev. Umpqua Bank $80.90 million

6/4/10 TierOne Bank $2,800 million Lincoln Neb. Great Western Bank $297.80 million

6/4/10 Arcola Homestead Savings Bank $17 million Arcola Ill. no buyer $3.2 million

6/4/10 First National Bank $60.4 million Rosedale Miss. The Jefferson Bank $12.6 million

5/28/10 Sun West Bank $360.7 million Las Vegas Nev. City National Bank $96.7 million

5/28/10 Granite Community Bank, NA $102.90 million Granite Bay Calif. Tri Counties Bank $17.30 million

5/28/10 Bank of Florida - Tampa $245.2 million Tampa Fla. EverBank $40.3 million

5/28/10 Bank of Florida - Southwest $640.9 million Naples Fla. EverBank $91.3 million

5/28/10 Bank of Florida - Southeast $595.3. million Fort Lauderdale Fla. EverBank $71.4 million

5/21/10 Pinehurst Bank $61.2 million Saint Paul Minn. Coulee $6 million

5/14/10 Midwest Bank and Trust Company $3.17 billion Elmwood Park Ill. Firstmerit Bank, National Association $216 million

5/14/10 Southwest Community Bank $96.6 million Springfield Mo. Simmons First National Bank $29 million

5/14/10 New Liberty Bank $109 million Plymouth Mich. Bank of Ann Arbor $25 million

5/14/10 Satilla Community Bank $135.7 million Saint Marys Ga. Ameris Bank $31.3 million

5/7/10 1st Pacific Bank of California $335.80 million San Deigo Calif. City National Bank $87.70 million

5/7/10 Towne Bank of Arizona $120.20 million Mesa Ariz. Commerce Bank of Arizona $41.80 million

5/7/10 Access Bank $32 million Champlin Minn. PrinsBank $5.50 million

5/7/10 The Bank of Bonifay $242.90 million Bonifay Fla. First Federal Bank of Florida $78.70 million

4/30/10 Frontier Bank $3.5 billion Everett Wash. Union Bank, N.A. $1.37 billion

4/30/10 BC National Banks $67.2 million Butler Mo. Community First Bank $11.4 million

4/30/10 Champion Bank $187.3 million Creve Coeur Mo. BankLiberty $52.7 million

4/30/10 CF Bancorp $1.65 billion Port Huron Mich. First Michigan Bank $615.3 million

4/30/10 Westernbank Puerto Rico $11.94 billion Mayaguez Puerto Rico Banco Popular de Puerto Rico $3.31 billion

4/30/10 R-G Premier bank of Puerto Rico $5.92 billion Hato Rey Puerto Rico Scotiabank de Puerto Rico $1.23 billion

4/30/10 Eurobank $2.56 billion San Juan Puerto Rico Oriental Bank and Trust $743.9 million

4/23/10 Wheatland Bank $437.20 million Naperville Ill. Wheaton Bank & Trust $133.00 million

4/23/10 Peotone Bank and Trust Company $130.20 million Peotone Ill. First Midwest Bank $31.70 million