12 minutes of info you need to see.

Friday, December 31, 2010

Thursday, December 30, 2010

Silver...Buy, Buy, Buy Before It Goes Bye, Bye, Bye

Silver may be the best buy when it comes to precious metals. You should consider getting some before it is too late.

Like I said, you better get some before it is too late, read here.

Prepare like there is no tomorrow, because someday there may not be a tomorrow like there is today.

Like I said, you better get some before it is too late, read here.

Prepare like there is no tomorrow, because someday there may not be a tomorrow like there is today.

The Big Fed Con

To understand how the Fed works, how the big banks work and how our politicians work, watch these two videos.

Silver $500 per Ounce?

I said silver, not gold. Well Max Keiser thinks it could reach $500/oz. Listen to the first ten minutes of this video.

Friday, December 24, 2010

Thursday, December 23, 2010

More Is Coming

There will be more cities defaulting on pension funds in the future. It has started with Prichard, AL. This is a small fund with 150 workers receiving a monthly check. Some people are going bankrupt, others relying on help from friends and family. I have a feeling 2011 won't be a good year.

I have been telling you for a while now to prepare, stock up on food and ways to protect yourself. Why you ask? What are these people going to do when their monthly checks run dry? Remember not all people receiving checks are 60+ years old. There are some that are getting checks due to "injuries" sustained while on the job. People will be getting desperate for anything to sell to get food for themselves or their family. What would you do to feed your family? Remember you are a law abiding citizen, some of these people will be looting and pillaging and who knows what else. We are close to tearing the thin film of morality for our society, that precautions while you still can.

Alabama Town’s Failed Pension Is a Warning

I have been telling you for a while now to prepare, stock up on food and ways to protect yourself. Why you ask? What are these people going to do when their monthly checks run dry? Remember not all people receiving checks are 60+ years old. There are some that are getting checks due to "injuries" sustained while on the job. People will be getting desperate for anything to sell to get food for themselves or their family. What would you do to feed your family? Remember you are a law abiding citizen, some of these people will be looting and pillaging and who knows what else. We are close to tearing the thin film of morality for our society, that precautions while you still can.

Alabama Town’s Failed Pension Is a Warning

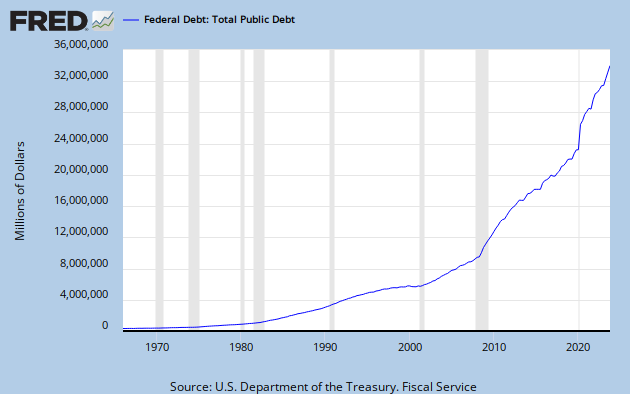

The Federal Debt Doubled In 5 Years

http://dailyreckoning.com/how-to-double-the-debt-in-5-years/

The above article is truely an eyeopener. Take the time and read it, but for those that don't like to read, I'll highlight a few snipets out so you can see the trouble we are in.

The above article is truely an eyeopener. Take the time and read it, but for those that don't like to read, I'll highlight a few snipets out so you can see the trouble we are in.

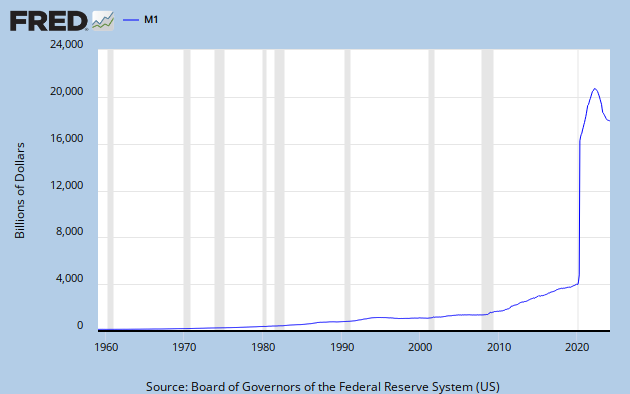

12/22/10 Tampa, Florida – As a paranoid and angry lunatic, I am always nervous and on the suspicious lookout for subtle signs of danger that I know are all around me because the foul Federal Reserve has created, and is still creating, So Freaking Much Money (SFFM), which means that the terror of ruinous inflation in prices is a dead-bang, take-it-to-the-bank, guaranteed certainty.

And there is no telling what people will do when faced with both the ruinous deflation of the value of their assets and the unbelievable, catastrophic inflation in the prices of food and energy that seems so sadly certain, which is a nice phrase if I do say so myself, conveying, as it does, a sense of resigned melancholy instead of my more usual hyperbole of anger, hatred, betrayal, outrage and thirst for revenge against the treacherous Federal Reserve for creating so much excess money and against the corrupt Congress for allowing it!

Unfortunately, this is not about how I have the lyrical soul of a poet, but about how these people are the same average idiotic Americans who have, for more than half of the last century, been electing and reelecting Congresses that have enacted huge, growing, cancerous budgets that deficit-spent a gigantic $14 trillion in new national debt – a sum equaling GDP!

And these same disastrous weenies have borrowed and deficit-spent more than half of that $14 trillion national debt in just the last 10 years! And now they are on track to double the debt again in the next 5 years! Gaaah!! We’re freaking doomed!

Doug Noland in his PrudentBear.com commentary does not mention this kind of mental and fiscal insanity directly, much less leading to the Hysterical Mogambo Conclusion (HMC) that we should be frantically buying gold, silver and oil in a frenzied, single-minded panic.

Instead, with the calm and dispassionate objectivity of the classic reporter, he notes that the latest Federal Reserve Z.1 “flow of funds” report shows that “This year will mark the second consecutive year where federal borrowings will have actually expanded more than the growth of total Non-financial borrowings. Nothing similar to this has happened in the post-WWII period.”

Yow! This is the kind of “danger signal” that I am talking about!

The actual figures are that in just the last 9 quarters, which a little over 2 years, “total federal liabilities” exploded by a whopping $4.013 trillion, which increased the national debt by 60% in those aforementioned Two Freaking Years (TFY)! TFY!

Even more astoundingly, “After doubling mortgage Credit in less than 7 years, our system is now on track to double federal debt in about four years.” Gaaahhhh! I thought it was 5 years! I scream anew in outrage and fear! Gaaahhh!

Suddenly, I am screaming in fear, but at the same time I am watching, as if in an out-of-body experience, little specks of spittle fly out of my mouth as I am screaming, and I am thinking to myself, “That’s the problem with linear thinking! If I pursued a career of fame and fortune as The World’s Fattest Man (TWFM) and weighed in at 1,500 pounds, can I actually double my weight in 4 years to 3,000 pounds? And then 4 years later double my weight again to 6,000 pounds? And then again to weigh 12,000 pounds?”

The answer is, obviously, “Not without a lot of tasty grub! Hahahaha!”

Fortunately, speaking of tasty grub calms me down enough so that I can read that the report also showed that combined local, state, and federal expenditures were up, and still totals about half of our $14 trillion GDP, even though the federal government borrowed and spent a whopping $1.8 trillion in the last 12 months, which may explain how Total Compensation increased 3.0% in the last year, rising to $8.03 trillion, which seems paradoxical since unemployment, at an “official” 9.8% and (according to John Williams at shadowstats.com) is unofficially 22%, is a Big, Big Problem (BBP).

Even more surprising was that Household Assets increased $1.2 trillion to $68.8 trillion, while Household Liabilities were $13.9 trillion and did not increase much because, I assume, people did not spend a lot of borrowed money in the last quarter.

The report handily subtracts liabilities from assets and concludes that that Household Net Worth increased $1.19 trillion during the third quarter, rising to a surprising $54.9 trillion, which is almost 4 times Liabilities, thus everything should be peachy keen and couldn’t be better except for, you know, that pesky unemployment thing.

If you believe that, then you will not be interested in the Mogambo Big Plan (MBP) to buy gold, silver and oil as protection against the roaring, catastrophic inflation caused by the Federal Reserve creating so much money, and the federal government borrowing it and spending it.

And to tell you the truth, I don’t know whether or not I believe any of it, and I only follow the Mogambo Big Plan (MBP) because it is fool-proof and so easy that I giggle with childish delight, “Whee! This investing stuff is easy!”

The Mogambo Guru

for The Daily Reckoning

And there is no telling what people will do when faced with both the ruinous deflation of the value of their assets and the unbelievable, catastrophic inflation in the prices of food and energy that seems so sadly certain, which is a nice phrase if I do say so myself, conveying, as it does, a sense of resigned melancholy instead of my more usual hyperbole of anger, hatred, betrayal, outrage and thirst for revenge against the treacherous Federal Reserve for creating so much excess money and against the corrupt Congress for allowing it!

Unfortunately, this is not about how I have the lyrical soul of a poet, but about how these people are the same average idiotic Americans who have, for more than half of the last century, been electing and reelecting Congresses that have enacted huge, growing, cancerous budgets that deficit-spent a gigantic $14 trillion in new national debt – a sum equaling GDP!

And these same disastrous weenies have borrowed and deficit-spent more than half of that $14 trillion national debt in just the last 10 years! And now they are on track to double the debt again in the next 5 years! Gaaah!! We’re freaking doomed!

Doug Noland in his PrudentBear.com commentary does not mention this kind of mental and fiscal insanity directly, much less leading to the Hysterical Mogambo Conclusion (HMC) that we should be frantically buying gold, silver and oil in a frenzied, single-minded panic.

Instead, with the calm and dispassionate objectivity of the classic reporter, he notes that the latest Federal Reserve Z.1 “flow of funds” report shows that “This year will mark the second consecutive year where federal borrowings will have actually expanded more than the growth of total Non-financial borrowings. Nothing similar to this has happened in the post-WWII period.”

Yow! This is the kind of “danger signal” that I am talking about!

The actual figures are that in just the last 9 quarters, which a little over 2 years, “total federal liabilities” exploded by a whopping $4.013 trillion, which increased the national debt by 60% in those aforementioned Two Freaking Years (TFY)! TFY!

Even more astoundingly, “After doubling mortgage Credit in less than 7 years, our system is now on track to double federal debt in about four years.” Gaaahhhh! I thought it was 5 years! I scream anew in outrage and fear! Gaaahhh!

Suddenly, I am screaming in fear, but at the same time I am watching, as if in an out-of-body experience, little specks of spittle fly out of my mouth as I am screaming, and I am thinking to myself, “That’s the problem with linear thinking! If I pursued a career of fame and fortune as The World’s Fattest Man (TWFM) and weighed in at 1,500 pounds, can I actually double my weight in 4 years to 3,000 pounds? And then 4 years later double my weight again to 6,000 pounds? And then again to weigh 12,000 pounds?”

The answer is, obviously, “Not without a lot of tasty grub! Hahahaha!”

Fortunately, speaking of tasty grub calms me down enough so that I can read that the report also showed that combined local, state, and federal expenditures were up, and still totals about half of our $14 trillion GDP, even though the federal government borrowed and spent a whopping $1.8 trillion in the last 12 months, which may explain how Total Compensation increased 3.0% in the last year, rising to $8.03 trillion, which seems paradoxical since unemployment, at an “official” 9.8% and (according to John Williams at shadowstats.com) is unofficially 22%, is a Big, Big Problem (BBP).

Even more surprising was that Household Assets increased $1.2 trillion to $68.8 trillion, while Household Liabilities were $13.9 trillion and did not increase much because, I assume, people did not spend a lot of borrowed money in the last quarter.

The report handily subtracts liabilities from assets and concludes that that Household Net Worth increased $1.19 trillion during the third quarter, rising to a surprising $54.9 trillion, which is almost 4 times Liabilities, thus everything should be peachy keen and couldn’t be better except for, you know, that pesky unemployment thing.

If you believe that, then you will not be interested in the Mogambo Big Plan (MBP) to buy gold, silver and oil as protection against the roaring, catastrophic inflation caused by the Federal Reserve creating so much money, and the federal government borrowing it and spending it.

And to tell you the truth, I don’t know whether or not I believe any of it, and I only follow the Mogambo Big Plan (MBP) because it is fool-proof and so easy that I giggle with childish delight, “Whee! This investing stuff is easy!”

The Mogambo Guru

for The Daily Reckoning

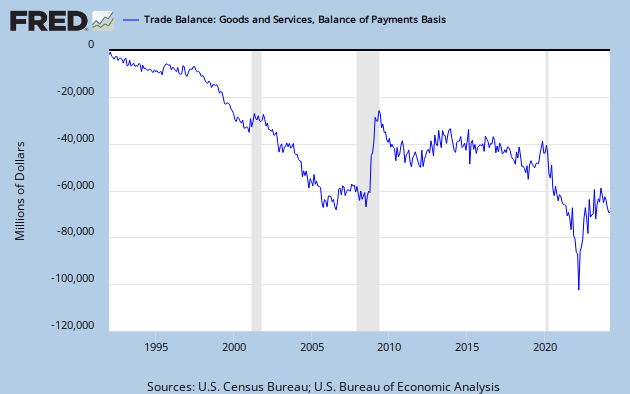

Cargo Ships Slowing

These ships are slowing their speed. There is a storm a coming, and it is not weather related.

You may want to look at the chart. Can you say double dip?

And I'm not talking a double dip like this...

http://www.youtube.com/watch?v=YWuSi00CcNk&feature=related

You may want to look at the chart. Can you say double dip?

And I'm not talking a double dip like this...

http://www.youtube.com/watch?v=YWuSi00CcNk&feature=related

Wednesday, December 22, 2010

Tuesday, December 21, 2010

Monday, December 20, 2010

States In Trouble...Say It Isn't So

Now CBS is not what one would call a uh, conservative media outlet. For them to run a piece like this, is almost unheard of.

Pay attention to the video. The States are in trouble. I hope you are not counting on or invested in a State pension or Municipal Bond.

Pay attention to the video. The States are in trouble. I hope you are not counting on or invested in a State pension or Municipal Bond.

Saturday, December 18, 2010

Look Here...

Here are a couple things that should have you concerned....

Federal Government Debt

Federal Surplus or Deficit

Money Stock (money in ciculation)

Trade Balance (looks like we are losing about $40 billion a year)

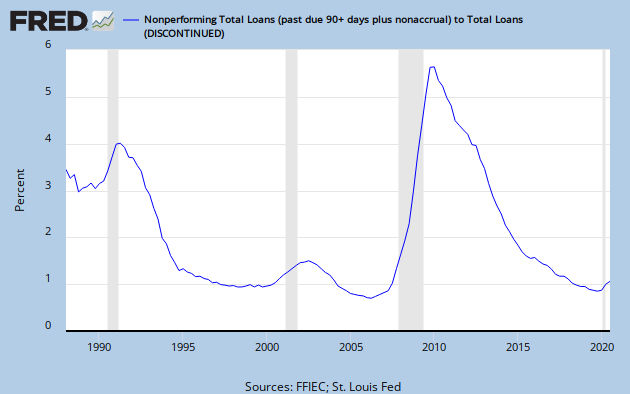

Non performing loans at banks

Makes you say...hmmm.

Keep your eyes open and start preparing.

Are You Ready?

If you haven't been paying attention, this is what is happening around the world.

First Greece....

and Rome....

and more being predicted.

You don't think this can happen here in America? Well, we only have a $14 trillion debt, $1.3 Trillion deficit last year, already $290 billion deficit for the first two months this budget year, States going broke, 47 million people receiving food stamps, corruption in banking and Wall Street, 157 bank failures so far in 2010, $100 trillion in unfunded liabilities, housing prices tanking, inflation occurring, and gold and silver hitting new highs...to name a few. Keep your head buried in the sand or start preparing.

First Greece....

and Rome....

and more being predicted.

You don't think this can happen here in America? Well, we only have a $14 trillion debt, $1.3 Trillion deficit last year, already $290 billion deficit for the first two months this budget year, States going broke, 47 million people receiving food stamps, corruption in banking and Wall Street, 157 bank failures so far in 2010, $100 trillion in unfunded liabilities, housing prices tanking, inflation occurring, and gold and silver hitting new highs...to name a few. Keep your head buried in the sand or start preparing.

Thursday, December 16, 2010

Silver and Gold, Silver and ....

Silver is what JP Morgan is asking for for Christmas. Seems they have been playing a game with us and they are losing. The seem to be a little no a lot short on physical silver. This video explains a lot.

Saturday, December 11, 2010

Hyperinflation May Be Only 6-9 Months Away

John Williams from Shadow Stats was interviewed by Business News Network. Below is the link. It is worth the 10 minutes.

http://watch.bnn.ca/squeezeplay/december-2010/squeezeplay-december-8-2010/#clip386602

http://watch.bnn.ca/squeezeplay/december-2010/squeezeplay-december-8-2010/#clip386602

Friday, December 3, 2010

Unemployment Now 9.8%...Hmmm

The "experts" were predicting that unemployment would go down to about 9.4%. Uh, well it went to 9.8%. This video will answer a few questions.

Subscribe to:

Posts (Atom)